What Are Small Amount Payments?

Small amount payments refer to transactions involving relatively low monetary values, often utilized in various industries to facilitate quick and efficient financial exchanges. Typically, these payments are characterized by their modest size, often falling below a certain threshold, such as $10, $20, or even $50, depending on the context. Common examples include microtransactions in online gaming, digital content purchases, subscription fees for streaming services, and even everyday purchases like coffee or snacks. This payment structure has gained immense popularity, particularly in the digital economy, as it allows consumers to access goods and services without the need for significant financial commitment.

The Rise of Small Amount Payments in Digital Transactions

The proliferation of e-commerce and digital platforms has significantly contributed to the rise of small amount payments. As consumers increasingly seek convenience and instant access to products and services, businesses have adapted their payment systems to accommodate these preferences. Digital wallets, mobile payment applications, and contactless payment technologies have emerged as key players in this space, enabling users to make quick transactions with just a few taps on their devices. Moreover, the growing acceptance of cryptocurrencies has introduced alternative payment methods that facilitate small transactions without the traditional banking intermediaries, further enhancing the appeal of small amount payments in the digital landscape.

Advantages of Small Amount Payments

One of the primary advantages of small amount payments is their ability to enhance customer engagement and retention. By allowing consumers to make low-cost purchases, businesses can attract a broader audience, including those who may be hesitant to commit to larger expenditures. Additionally, small transactions can stimulate impulse buying behavior, leading to increased sales and revenue for merchants. Furthermore, the low-risk nature of these payments can encourage experimentation with new products or services, fostering brand loyalty over time. For consumers, small amount payments provide the opportunity to access a diverse range of offerings without financial strain, promoting a more enjoyable shopping experience.

Challenges and Considerations

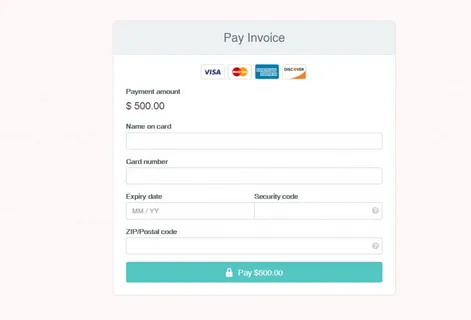

Despite the numerous benefits, small amount payments also present certain challenges that businesses must navigate. Transaction fees can significantly impact profitability, especially for very low-value payments. Many payment processors impose fixed fees that may outweigh the revenue generated from a small transaction, prompting businesses to carefully consider their pricing strategies. Additionally, security concerns surrounding digital payments, such as fraud and data breaches, can deter some consumers from engaging in small amount transactions. To address these issues, companies must invest in robust security measures and transparent communication to build consumer trust in their payment systems.

In conclusion, small amount payments play a vital role in today’s economy, driven by technological advancements and shifting consumer preferences. By understanding their significance, advantages, and associated challenges, businesses can effectively leverage this payment model to enhance customer satisfaction and drive growth. As the landscape of digital transactions continues to evolve, small amount payments will likely remain a key component of modern commerce.문화상품권신용카드